The Power Strain

The explosive rise of artificial intelligence has made semiconductors the new oil, but electricity may become the new constraint. As demand for data centers surges, driven by large language models and the companies that are building them, America’s power grid is being pushed to its limits. The U.S. is beginning to face a growing energy crisis, compounded by geopolitical tensions and a stalled transition to sustainable resources.

The AI Energy Drain

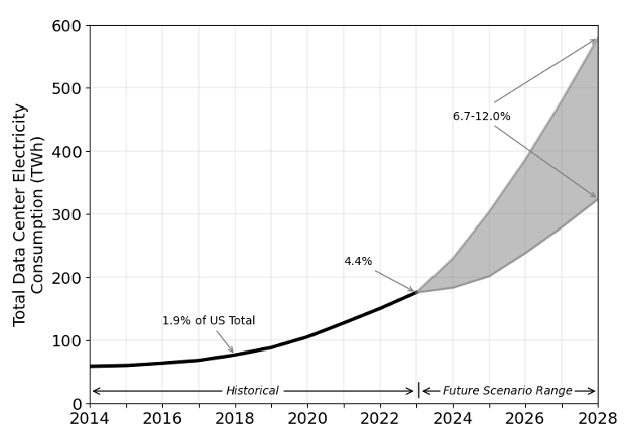

The rise of artificial intelligence is reshaping not just software and hardware; it’s shaking the very foundation of America’s energy grid. The average query typed into ChatGPT requires about 10 times as much electricity as a Google Search. This is according to Goldman Sachs who in a recent report cited that they expect overall electricity demand to rise approximately 2.4% from 2022 to 2030. AI workloads are extraordinarily power-hungry, and the data centers needed to support them are being built at a staggering pace. According to a recent report by the U.S. Department of Energy and the Lawrence Berkeley National Laboratory, data centers could consume up to 12% of all U.S. electricity by 2028, up from roughly 3-4% in 2022. That would mark a fourfold increase in just six years – a growth curve that rivals the early internet era but with exponentially higher power demands.

Globally, data centers consumed about 415 terawatt-hours of electricity in 2024, accounting for around 1.5% of total global power usage. This figure is comparable to the total consumption of Saudi Arabia. Advanced AI models like OpenAI’s ChatGPT-4 and Google’s Gemini require not only massive computational firepower to train, but also continuous electricity to run inference at scale. To put it in perspective, at the current growth rate, AI data centers could require over 20 GW of power capacity by late next year or early 2027. This is the equivalent to the output of 20 large nuclear reactors.

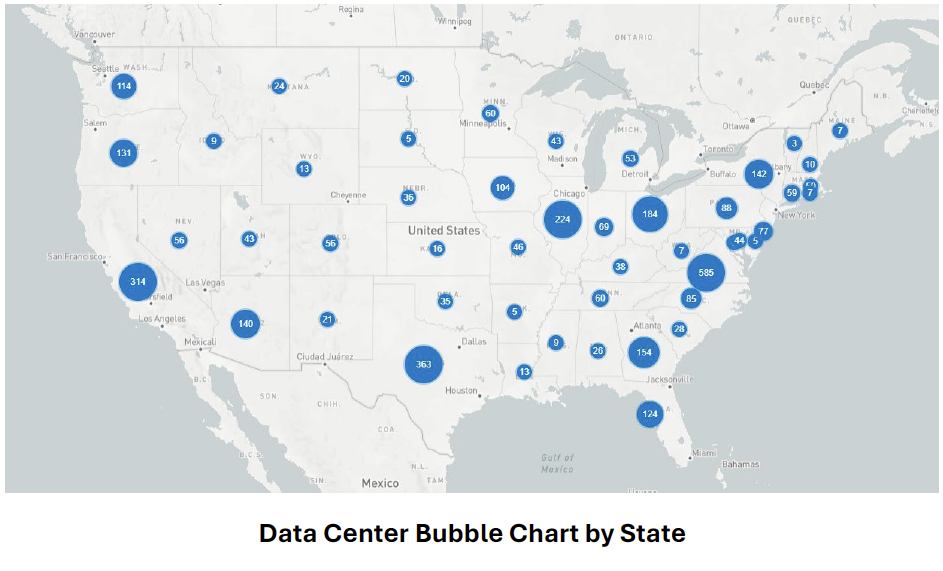

Beyond national statistics, the demand is concentrated in particular regions. States like Virginia, Texas, Illinois, and Georgia have become major hubs for data center development due to tax incentives, access to land, and relatively low-cost electricity. Northern Virginia, dubbed “Data Center Alley” already hosts the highest concentration of data centers in the world and Dominion Energy, the state’s primary utility, has warned that demand is beginning to exceed what the local grid can reliably deliver.

This energy crunch bears little resemblance to the internet boom of the 1990’s. Then, the bandwidth was the bottleneck. Now, it’s raw power. The leap from web hosting to running multi-trillion parameter AI models is a massive shift in scale. To put things in further perspective, ChatGPT currently has over 400 million weekly users, but there are around 5.3 billion internet users globally. Imagine if every internet user decided to start using the energy-intensive ChatGPT. Not to mention, ChatGPT servers are located primarily in the U.S. With 5,400 total data centers in the United States the constant uptime and immense cooling infrastructure are further problems that can’t be ignored. Unlike traditional software applications, which can often run efficiently on standard CPUs, AI applications lean heavily on GPUs and other high-performance semiconductors/chips that consume far more electricity per computation.

In short, AI isn’t just consuming compute – it’s devouring electricity. If growth projections hold, the infrastructure built to support the AI revolution may become one of the largest single drivers of energy demand in the U.S. The question is no longer whether the need is real. The question is whether the United States has the power system to keep up.

America’s Aging Infrastructure

The answer is complicated. Much of America’s electric grid was built in the 1960’s and 1970’s and today, about 70% of the nation’s transmission lines are over 25 years old. According to the U.S. Department of Energy, many of these lines are approaching the end of their typical 50-80 year lifespan, putting the country at increasing risk of grid failures. Without major upgrades, the consequences could be severe – ranging from frequent blackouts, to cybersecurity vulnerabilities, to emergency level disruptions from aging, overloaded infrastructure.

The growing electrification of everything – cars, homes, factories, and now AI infrastructure – adds to the urgency. Yet despite the bleak state of the current grid, there are signs of momentum. In October of 2024, the Department of Energy announced the second round of Grid Resilience and Innovation Partnerships Program (GRIP) funding, directing $4.2 billion in federal funding toward 46 projects across 47 states. Backed by bipartisan support, GRIP aims to modernize grid systems through investments in wildfire prevention, support for disadvantaged communities, and neighborhood resilience. Each of these areas are critical in a more electrified and weather-volatile future.

Still, progress isn’t guaranteed. A number of these projects remain in limbo due to the current tax and spending bill stalled in the Senate. Delays in permitting, grid connection approvals, and interstate coordination also continue to hold back large-scale upgrades. The permitting process for transmission lines, in particular often drags on for years because of fragmented regulatory authority.

Yet there’s a blueprint for how the U.S. can push forward. The Smart Electric Power Alliance (SEPA) outlines a four-step plan to shift toward a more modern, adaptive grid. First: maximize and optimize existing infrastructure, such as increasing capacity through advanced grid software. Second: protect and reinforce what we already have, including investments in climate and cyber-resilience. Third: improve system flexibility through the integration of distributed energy resources like microgrids and battery storage. Fourth: Align policy and stakeholder collaboration from utilities and regulators to retailers and end users, progress can’t be stymied by red tape or misaligned incentives.

While grid modernization lays the foundation, it still begs the question: where will all this new electricity come from? Even the most sophisticated grid is useless without a reliable, scalable power supply behind it. As clean energy struggles to move into the limelight and the AI boom accelerates, the U.S. is being forced to reckon with a familiar reality that traditional energy sources are still very much in play.

Fossil Fuels & the Nuclear Pivot

As the United States races to meet the electricity needs of a more digitized economy, it finds itself relying on an uncomfortable mix of old and new energy sources. Natural gas, often referred to as the transition fuel in the clean energy shift, still plays a central role in supporting grid reliability. It is fast to dispatch, relatively abundant, and cleaner than coal. Nonetheless, there is growing debate over whether it can scale fast enough to meet the accelerating demand driven by artificial intelligence, electric vehicles, and industrial electrification. Pipeline permitting challenges and the slow development of new gas-fired generation plants have created a mismatch between availability and need.

Meanwhile, global oil dynamics continue to cast a long shadow over energy markets. Prices have remained volatile due to tensions in the Middle East. In a span of just a few weeks, Brent Crude jumped from $59 to over $81 per barrel driven by heightened conflict between Israel and Iran. The surge sent a clear message to energy markets: even in a world pivoting towards other forms of energy, oil shocks carry enormous macroeconomic weight.

In response to both short-term energy reliability concerns and long-term decarbonization goals, nuclear power is once again in focus. The resource offers consistent, carbon-free electricity that does not depend on weather or fossil fuel supply chains. Small Modular Reactors or SMRs are leading this renewed interest. These smaller, scalable designs promise shorter construction timelines and more flexible deployment compared to traditional nuclear power plants. Although widespread adoption is still years away, momentum is building.

Corporate energy buyers are no longer treating nuclear as a legacy asset but as a critical part of future supply planning. In early June, Meta Platforms signed a 20-year agreement with Constellation Energy to power its Illinois-based data center using energy from the Clinton Clean Energy Center. Microsoft has struck a similar deal with Constellation to commission the historic Three Mile Island nuclear facility in Pennsylvania. Amazon is supporting the development of new SMRs in the Pacific Northwest through a partnership with Energy Northwest. These moves mark a shift from cautious interest to real capital commitments among the largest tech firms in the world.

Despite this progress, nuclear power is still challenged by high costs, regulatory delays, and local opposition. Building new capacity often requires navigating both federal and state approvals, while maintaining public trust in nuclear safety remains a delicate task (If you’re not from PA, do some research into March 1979 at Three Mile Island). Even so, the growing alignment between public energy goals and private market demand is giving nuclear a new role in the next phase of America’s power strategy.

Market Implications

The growing energy strain is beginning to influence sector dynamics, investment flows, and long-term economic expectations. Utilities with strong regional footprints and exposure to fast-growing data center markets are positioned to benefit from rising electricity demand. Companies tied to nuclear energy are also gaining attention, especially those involved in small modular reactor development. Data center real estate investment trusts continue to attract interest as investors recognize the importance of power-secure facilities in the age of artificial intelligence.

While many opportunities arise within capital markets, the risks are just as significant. Areas with limited transmission capacity or delayed infrastructure upgrades may struggle to attract new investment or retain existing businesses. Consumers and smaller firms could face rising energy bills as utility companies pass along the cost of new infrastructure and generation projects. These cost increases may feed into broader inflation, particularly for energy-intensive industries.

This market environment is likely to drive a reallocation of capital across markets, with investors eyeing what could be the golden ticket solution to this energy shortage. Energy infrastructure is becoming a priority and investor interest is expanding to include grid modernization, utility-scale storage, and alternative energy solutions. As the relationship between power and innovation deepens, those who upgrade the infrastructure behind the digital economy may emerge as the next generation of market leaders.

America’s technological ambitions risk outpacing its power capacity. The AI revolution won’t be stopped, but without energy to feed it, it may flicker instead of burn.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

LPL Compliance Tracking #762553