Powell Under Pressure

Nothing says monetary tension like a photo op in hard hats. When President Trump and Fed Chair Jerome Powell toured the under-renovation Marriner S. Eccles Federal Reserve building in Washington D.C., the visit was more than just a symbolic walkthrough. It marked the latest chapter in Trump’s long-running campaign to pressure the central bank into cutting interest rates.

Trump and Powell’s uneasy relationship stretches back further than many remember. In November of 2017, Trump nominated Powell as Fed Chair. By mid-2018, after the FOMC had raised rates twice, Trump began publicly expressing dissatisfaction. In a July 2018 interview with CNBC, he said he “didn’t approve” of the hikes but still backed his nominee, calling Powell “a very good man.” He concluded the interview noting on the rate hikes, “I am not happy about it. But at the same time, I’m letting them do what they feel is best.”

That tone didn’t last. By 2019, after two more interest rate hikes in 2018, President Trump’s frustration with Powell boiled over. He repeatedly criticized the Fed’s actions and famously compared Powell to “a golfer who can’t putt.” As the global economy inched closer to a then-unseen pandemic-era collapse, Trump intensified his demands for rate cuts and eventually, he got them. In the latter half of 2019, the Fed cut rates. Not once. Not twice. But three times. Trump remained unsatisfied. The day after the final 25-basis point cut brought the range down to 1.50% – 1.75% President Trump tweeted, “China is not our problem, the Federal Reserve is!”.

Given that history, it’s no surprise that Trump is again urging the Fed to ease rates from their current 4.25% to 4.50% range.

Back in the Crosshairs

Even before retaking office in January 2025, Trump made clear that Powell’s job was far from secure. In early 2024, he stated he would not renominate Powell if reelected. Since then, he has escalated his critiques of the Fed’s policy and Powell’s leadership. His latest pressure point is the more than $2 billion renovation of the Federal Reserve’s headquarters. The Trump administration has questioned the scale and cost of the project, and just a week before the photo-op tour, Trump suggested that Powell’s handling of the renovation “could be grounds for firing.” He later walked back the comment.

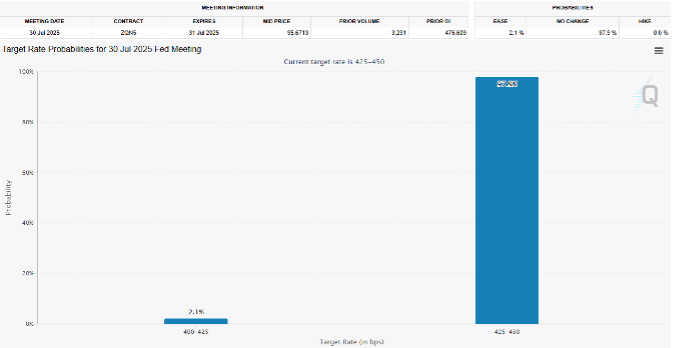

Now as the FOMC kicks off its July meeting, the central bank is widely expected to keep rates unchanged for the fifth straight time. While markets are pricing in near certainty of a hold, the FOMC minutes and Powell’s remarks may offer clues about whether a rate cut could arrive as soon as September. With Trump increasing the political heat, every word will be scrutinized.

The Case for a Cut

While independence of the Federal Reserve is essential to sound policymaking, the question arises: Is the President simply “working the referees” of our interest rate environment because they’ve made the wrong call? Below are several reasons why a rate cut might be economically justified.

Recession Risk and Economic Softening

Although talks of a recession have cooled, cracks are still showing beneath the surface. The U.S. economy has remained resilient, supported by consumer spending, a tight labor market, and equity markets hitting all-time highs. Broader data tells a more cautious story. The Conference Board’s Leading Economic Indicator, a composite measure of forward-looking indicators, continues to flash recessionary signals. Manufacturing hours are near their October lows, private new housing permits have retreated from 2021 highs, and consumer business expectations remain pessimistic. The Fed has historically acted preemptively to preserve expansions by cutting rates in response to subtle but mounting weakness. If growth data further deteriorates, the case for a rate cut will strengthen.

Debt Servicing Relief

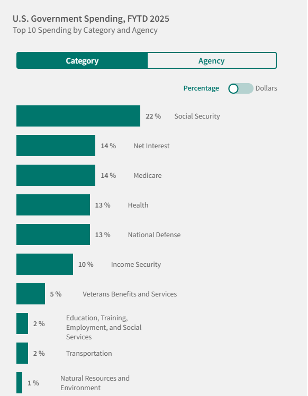

Trump has zeroed in on the rising cost of federal debt and for good reason. After two years of aggressive rate hikes in 2022 and 2023, the U.S. federal government is now spending more on interest payments than on national defense. With deficits at historic peacetime levels, high interest rates threaten to crowd out public investment. But the burden isn’t limited to Washington. Households and corporations with floating-rate or maturing debt are facing a sharp rise in borrowing costs, which curtails spending and investment. In lower-rated segments of the corporate bond market, refinancing risk is growing. While the Fed’s mandate doesn’t explicitly include managing debt loads, the increasing strain of interest payments across the economy is becoming harder to ignore.

Persistently High Mortgage Rates

Mortgage rates near multi-decade highs are freezing the housing market. Affordability has plummeted, sidelining first-time buyers and dampening demand. This slowdown extends beyond home sales, affecting construction, durable goods, and consumer confidence. With refinancing opportunities vanishing and equity withdrawal curtailed, the housing sector’s drag on consumption is intensifying. In regions heavily reliant on construction or housing-related services, the pain is even more acute, creating pockets of recessionary pressure that feed into broader concerns about growth. If weakness in housing begins to spill over into employment and demand more broadly, the Fed may find itself compelled to ease policy despite inflation concerns.

The Case Against a Cut

Despite growing calls for a cut from the White House, the Federal Reserve has compelling reasons to stay the course.

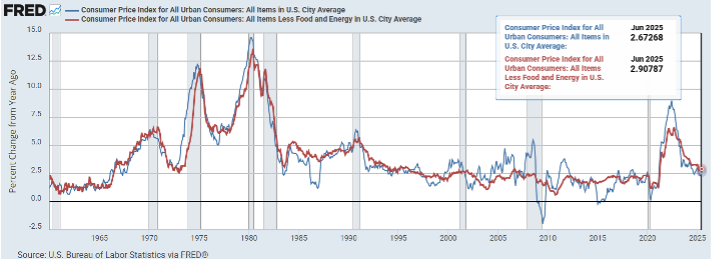

Inflation Persistence and Labor Market Strength

Perhaps the most fundamental argument against a rate cut is that inflation, while cooler than its 2022 peak, remains above the Federal Reserve’s long run target of 2%. Particularly sticky categories include services, shelter, and wages. Easing rates too soon runs the risk of reaccelerating price pressures just as the Fed is making progress. Historically, premature rate cuts during inflationary periods have led to stop-and-go policy mistakes, which can destabilize markets and extend the timeline for restoring price stability. Think Fed Chair Arthur Burns in the 1970’s who eased too early and let inflation run rampant. Compounding the challenge is a labor market that, although softening at the margins, remains historically tight. Unemployment is still low, job creation is positive, and wage growth while moderating continues to run above pre-pandemic levels. As long as consumer spending holds up and employers continue hiring, the Fed has little immediate economic justification for pivoting to a more accommodative stance.

Fed Independence and Credibility Risk

The Federal Reserve’s strength lies in its independence. If it cuts rates under visible political pressure, especially from a President with a track record of attacking the institution, it risks undermining that credibility. The Fed is designed to be insulated from short-term political cycles for precisely this reason: to make decisions based on data, not electoral timelines or political optics. If markets begin to perceive that rate cuts are being driven by the White House rather than macroeconomic fundamentals, confidence in the Fed’s commitment to price stability and maximum employment could erode. That loss of credibility could have long-lasting consequences, including upward pressure on long-term inflation expectations and Treasury yields. Once independence is compromised, it becomes far more difficult for the Fed to anchor expectations or execute effective future policy shifts.

Financial Conditions Are Still Loose

Despite the Fed’s aggressive tightening cycle, financial conditions across many asset classes remain relatively loose. Equity markets are hitting all-time highs, credit spreads remain tight, and corporate borrowing among investment-grade issuers remains robust. Consumers, while facing higher borrowing costs, continue to spend at a healthy clip, and asset valuations in both public and private markets reflect a risk-on sentiment. In this context, a rate cut could further inflate asset prices and overstimulate risk-taking. The Fed’s goal is not to maximize asset prices but to ensure price stability and sustainable growth. Loosening monetary policy amid such buoyant conditions could overstimulate the financial system.

As the July FOMC meeting gets underway, the Federal Reserve faces not just an economic balancing act, but a political one. President Trump’s calls for lower rates are loud, persistent, and public. But history shows that yielding to political pressure often comes at a high cost. Whether or not a cut is appropriate will depend on the hard data, not headlines. And for Powell and the FOMC, the challenge is clear: hold the line on credibility while staying responsive to a shifting economic landscape.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

LPL Compliance Tracking #: 776446