Economic & Market Report: Bond Market Broadside

The bond market sustained its latest broadside from the U.S. hot economic data warship on Thursday. Not only did the advance reading for 2024 Q1 U.S. GDP come in weaker than expected, but inflation readings also came in hotter than expected. This “stagflationary” barrage was enough to propel Treasury yields to their highest levels in more than six months. What should we reasonably expect from bonds going forward given the already tough start to the year in 2024?

Aiming higher. In October of last year, the 10-Year U.S. Treasury yield crested at 5%, its highest levels since before the Great Financial Crisis nearly two decades ago. At the time, pricing pressures were proving stubbornly persistent and the U.S. Federal Reserve was still talking “higher for longer” tough on interest rates.

By the end of the year just over two months later, everything had changed. Investors suddenly turned sanguine on the inflation outlook, and expectations for interest rate reductions from the U.S. Federal Reserve extended as high as two percentage points worth of cuts. This sparked a furious rally in the bond market, with 10-Year U.S. Treasury yields falling below 3.8% to close out last year.

But since the start of 2024, the bond market has been giving it all back. In the wake of a steady stream of hotter than expected economic data on growth, employment, retail sales, and inflation among others, the 10-Year U.S. Treasury yield has risen as high as 4.74% and is now within a quarter point striking distance of its October 2023 highs at 5%.

This raises an important question. Was the late 2023 bond rally the start of something good for bonds, or was it an oasis in an ongoing sea of red?

The inflation trend remains the bond market friend. Indeed, the hotter than expected economic data in recent months has justifiably taken the wind out of the bond market sails. And a suddenly weak reading on GDP coupled with another hot salvo on inflation made matters even worse. After all, as this Chief Market Strategist has been emphasizing since the middle of last year, the primary downside risk to capital markets going forward is a renewed rise in inflation. And if you add weak economic growth to the mix, it only compounds the problem since policy makers are constrained in cutting interest rates to support a weakening economy.

Nonetheless, it is important to reiterate that while inflation data has been stronger than expected as of late, the trend in the annual inflation rate on the Personal Consumption Expenditures (PCE) headline and core price indices, which is the preferred source for inflation data by the U.S. Federal Reserve, remains definitively to the downside.

This leads to a particularly important data point worth watching on Friday. The Bureau of Economic Analysis is set to release its latest monthly readings for March 2024. Here are some key numbers to watch in reviewing the release. The latest headline and core PCE inflation readings were 2.45% and 2.78%, respectively. According to the latest projections from the Cleveland Fed Inflation Nowcast, headline PCE inflation is expected to come in reasonably higher at 2.65%, but more importantly core PCE inflation is anticipated to tick marginally lower to 2.74%. In short, we could see a marginal bump in headline PCE inflation, but the market should be prepared for this outcome. It will be the core PCE reading in particular that’s worth watching to see if it can hold its ground for the most recent month.

More important than the latest monthly readings are the broader trends in PCE inflation. They have been definitively to the downside since mid-2022 when inflation peaked. And even if they blip marginally higher for March, a single data point does not make a trend. We will need to monitor the next few months ahead to see if any initial uptick eventually represents a full-blown reversal in inflation. And as long as the trend remains flat to lower, this is supportive of the bond market.

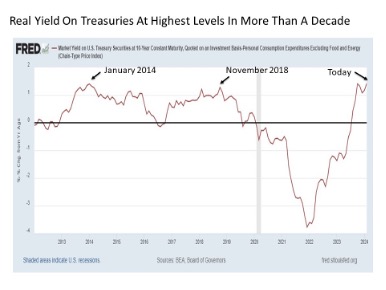

Increasing separation. Another factor increasingly favoring the bond market in general and the Treasury market in particular is the steadily increasing yield that investors are receiving above the rate of inflation, otherwise known as the real yield. So as the inflation rate continues to slowly drift lower, it is making the real yield on bonds all the more attractive as they continue to rise.

As one of many examples, consider the 10-Year U.S. Treasury yield relative to the annual inflation rate of the Fed’s preferred Core PCE price index. This spread that investors are being paid above this inflation gauge has risen above +1.2%, which marks its highest level in more than a decade.

So what happened with forward bond returns the two most recent times this particular real yield reached comparable levels?

The first peak took place in January 2014 in the wake of the Fed’s third quantitative easing program and the so called “taper tantrum” that sent bond yields higher sharply higher over the previous year. Over the subsequent two-and-a-half years through mid-2016, Treasuries steadily rallied in price alone by nearly double-digits. Add in the income paid by these bonds and the total return was close to +20%.

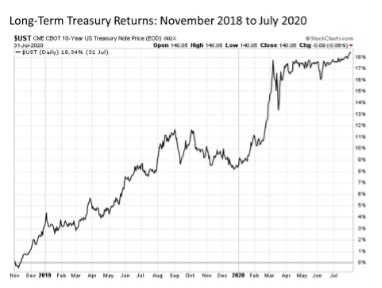

The next peak took place in November 2018 in the wake of eight (and eventually nine) quarter point interest rate hikes by the U.S. Federal Reserve. Over the next two years, U.S. Treasuries rallied by nearly +20%, with a good portion of this rally taking place even before on the onset of COVID.

How the bond market responds in the current environment will depend much on how the inflation data in particular unfolds in the coming months. But if recent history is any guide and 5-year breakeven inflation rates still below 2.5% are any indication, the bond market may have a good foundation for expected upside over the coming 24 to 36 months at current levels.

Bottom line. The bond market has endured its latest economic data hit this week. But if current trends in inflation continue to hold, the risk-reward profile for bonds is becoming increasingly favorable for bonds going forward.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

DOWNLOADABLE PDF PENDING COMPLIANCE REVIEW FOR USE WITH THE PUBLIC.